Housing Affordability is Tanking – What That Means For Sales

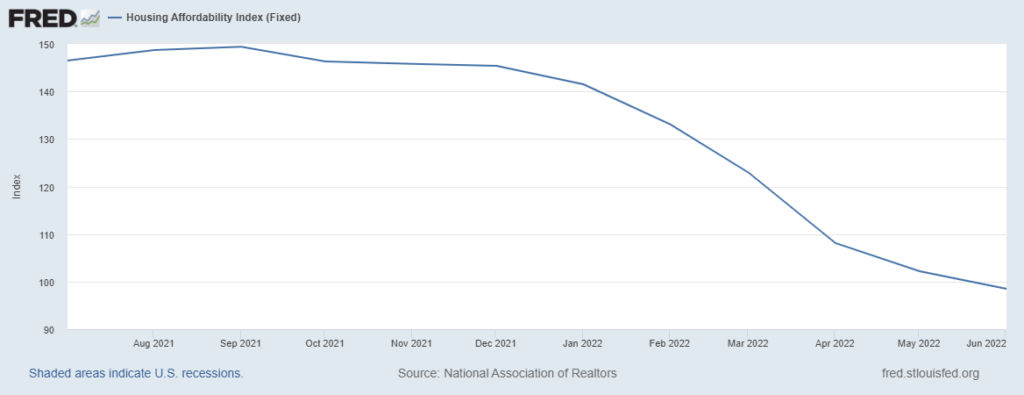

For the first time in more than 13 months, the Housing Affordability Index (HAI) has dropped below 100. As recently as September 2021, the index was soaring at 149. For reference, the number 100 is the benchmark used to determine whether homeownership is affordable. Anything above 100 means the average American household has just enough money to afford a median-priced home. The higher it goes, the ampler the funds.

But, while the real estate market has been riding high throughout the pandemic, it has become clear that home sellers are in for a rude awakening. That’s because, since its 13-month peak in September, the index has been in a steep decline, dropping down below 100 back in June.

Understanding the Housing Affordability Index

The National Association of Realtors collects housing market data and supplies it to the Federal Reserve to help keep a finger on the pulse of the housing market.

Calculating the Housing Affordability Index takes into account three factors:

- Median home prices – this is based on sales data from NAR

- Effective mortgage rates – pulled from the Federal Housing Finance Board

- The estimated monthly mortgage payment (assuming a buyer has a 20% down payment) for a median-priced home

Now, there are a lot of calculations that go into determining the HAI, but the concept is actually pretty simple. As mentioned above, anything above 100 is good news for buyers. That’s because it means they have just enough money to afford a median-priced home.

The higher the number goes, the more affordable homeownership becomes. However, when the number falls below 100, as it did in June of this year, that’s a red flag that prices are becoming less affordable.

What is Fueling the Drop in Affordability?

While there are many factors fueling the decline in housing affordability, the top five include:

1. Soaring home prices

2. Rising mortgage rates

3. Continued supply-chain woes

4. The great reshuffling

5. Economic uncertainty

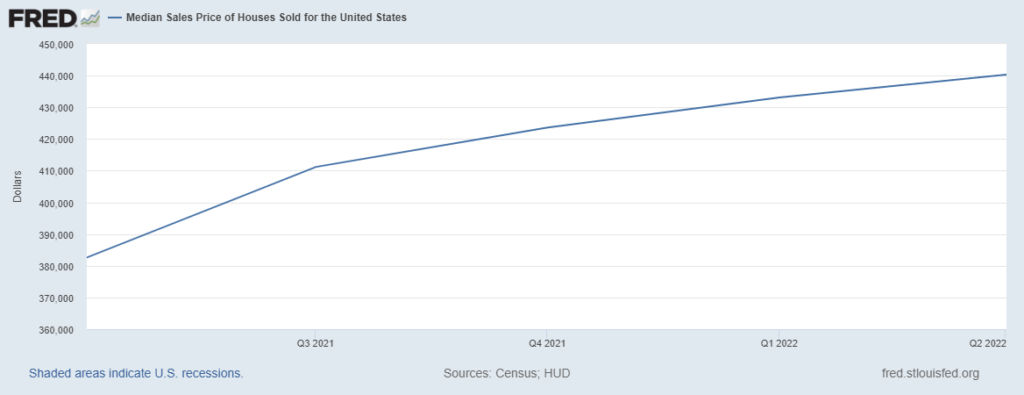

1. Soaring Home Prices

Home prices have been on the rise for several years now, but they’ve surged to new heights in recent months. The median home price in the U.S. is now $440,300, which is up more than 15% from Q2 2021 of $382,600.

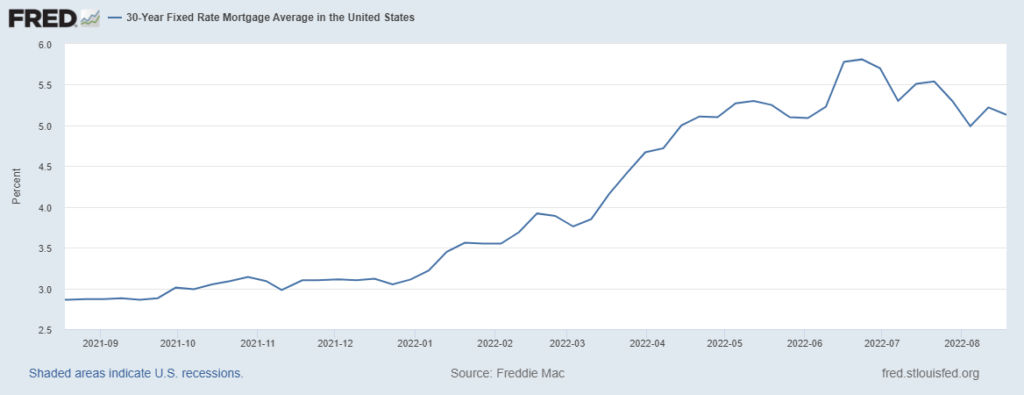

2. Rising Mortgage Rates

Mortgage rates are still historically low, but they have been on the rise since last year. The average 30-year fixed-rate mortgage is now 5.13%, up from 3.22% in January.

3. Continued Supply Chain Woes

The pandemic has wreaked havoc on the housing market in a number of ways, but one of the most significant has been the disruption of the supply chain. This has made it difficult for builders to obtain the materials they need to construct homes, leading to a decrease in new home construction.

4. The Great Reshuffling

The pandemic has also caused many Americans to rethink their housing needs. Some are looking for more space, while others are leaving cities for suburban or rural areas. This has led to a decrease in demand for urban homes and an increase in demand for homes in the suburbs and exurbs.

5. Economic Uncertainty

The last few months have been marked by economic uncertainty, not only in the US but globally. This has led many people to put their home-buying plans on hold, as they wait to see how the economy will unfold.

So, What Does This Mean for the Housing Market?

Buyers and sellers are going to experience a shifting dynamic in the real estate market.

Prior to the pandemic, many would-be buyers were priced out of the housing market. The combination of low inventory and high demand meant that prices were going up at an unprecedented rate, while wages remained relatively stagnant.

But now, as some of the economic chaos that ensued in 2020 rapidly cools, ripples are being felt across the housing market. While the mood is shifting from a seller’s to a buyer’s market, if housing affordability continues its downward spiral, it could create an even more serious problem.

The good news is that, while things may be cooling off in the housing market, there are still plenty of opportunities for buyers who are looking to get into the market. It’s just a matter of being smart about your purchase and doing your research to understand the trends in your local housing market.