- Florida Remains Hot While the Nation Cools

- Florida’s Enormous Housing Appreciation

- Florida Housing Market Overview

- The Florida Population: Massive Growth and a Younger Demographic

- Florida Faces a Housing Shortage

- Homes in Florida’s Cities Drive Growth

- Home Insurance is a Rising Issue

- Is it a Good Time to Buy or Sell in Florida?

- Florida Housing Market Predictions 2024

- Find a Trusted Florida Real Estate Agent

Florida Housing Market: Trends & Predictions 2024

Click here to browse our Real Estate Agent Directory and contact top-rated agents in your area!

The state of Florida has long been known for its amazingly sunny weather. But recently, it’s been making headlines for another reason: its housing market. Not only does Florida seem to be immune to the issues plaguing the rest of the country and their housing shortages, it is actually seeing growth.

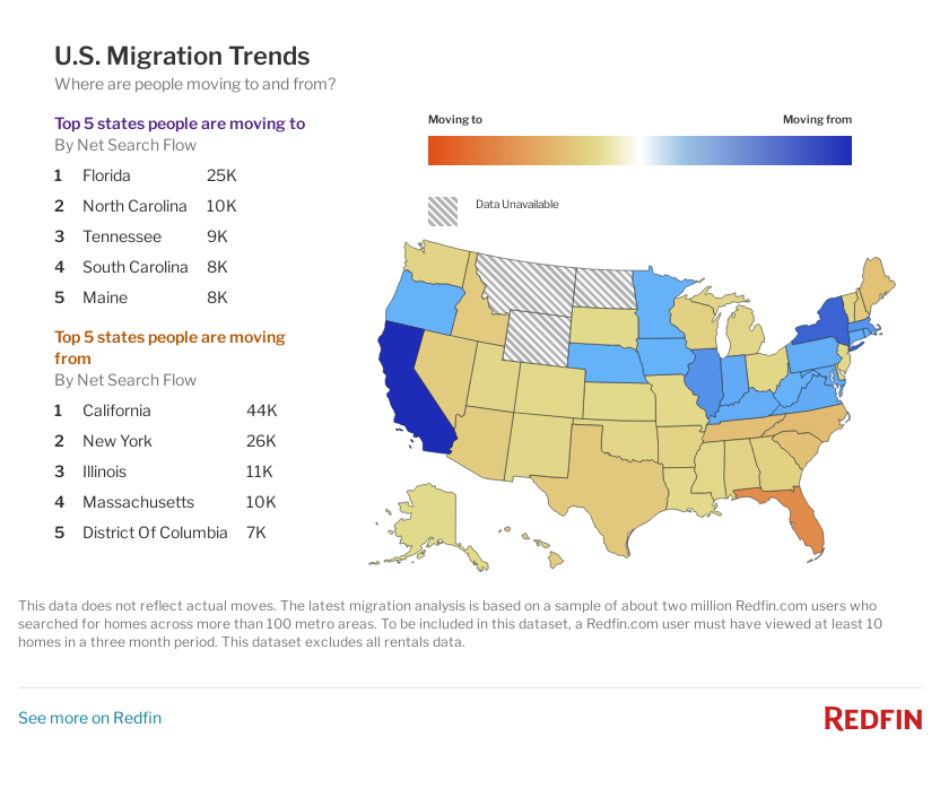

Population growth in the Sunshine State has been a primary driver for rising housing costs. The state is seeing more and more interstate migration, especially in the wake of the COVID-19 pandemic. New residents arrive seeking a better quality of life, including more space and more time in the outdoors. In fact, nearly 1,000 people move to Florida every day!

The Florida housing market is fascinating. Whether you’re a long-time resident, curious about what’s going on in the state, or an outsider looking to move to Florida, read on to learn everything you need to know about the Florida housing market and read our Florida housing market predictions for 2024.

Key Takeaways:

- Florida is the #1 state people are moving to

- The Florida housing market overtook New York to be the 2nd most valuable market in the United States

- Florida ranks 3rd in the country for new home builds

- Florida home values have risen by 1.1% year over year

Florida Remains Hot While the Nation Cools

Over the past several years, Florida has been in the center of the media for marching to a beat of its own. The beat has proven to be quite successful. Droves of people are flocking to Florida, and the housing market is thriving while the rest of the United States has cooled.

Florida’s Enormous Housing Appreciation

Those lucky enough to have bought in Florida prior to the Pandemic have experienced significant appreciation of their homes. From the start of the Pandemic (March 2020) to three years later (March 2023), home values rose 53%, according to Zillow data.

For comparison, in the three years prior to the Pandemic (March 2017-2020), home values rose 21%, also an impressive appreciation.

Yet the rise in home values over the past three years has been phenomenal. Even as home values across the United States rose 36% over the past three years, Florida’s growth has pushed far above that.

Florida Housing Market Overview

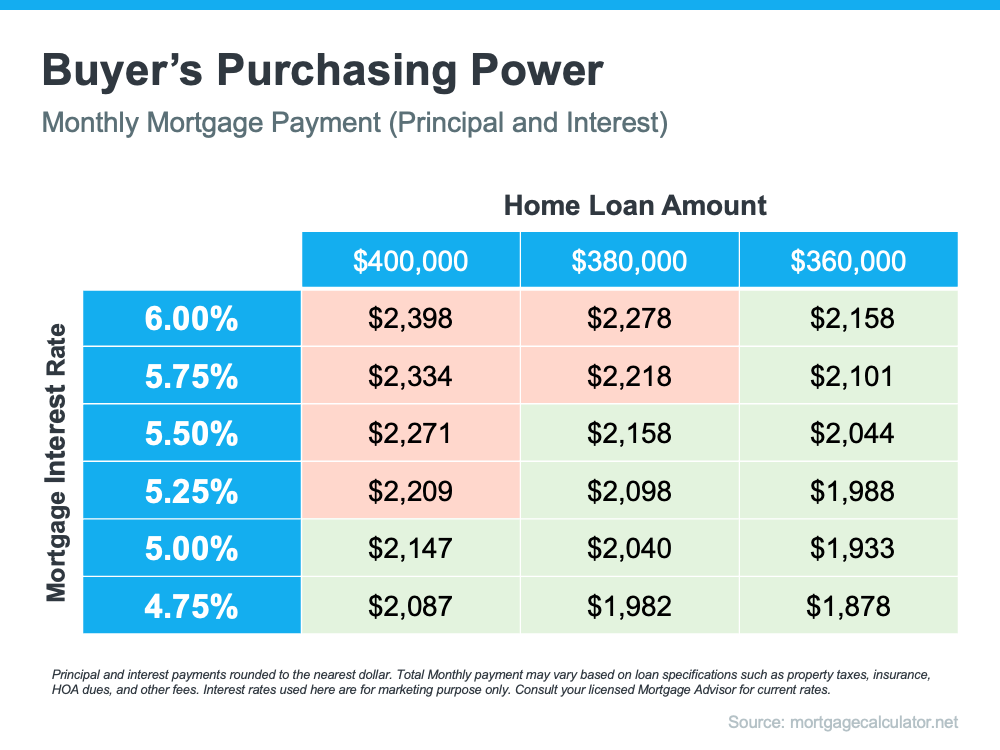

2023 saw a modest rise in home values in Florida. As interest rates rose, many buyers were forced to reduce their desired price range or leave the market completely. In addition, inflationary pressures altered buyers’ budgets for food and everyday essentials, resulting in less money left to put towards buying a home.

Nevertheless, despite rising mortgage rates, home prices still rose in Florida, and homes continue to move off the market, albeit at a slower pace.

Let’s take a look at some of the key statistics for the Florida real estate market.

Home Values Rose Modestly

Typical home values in Florida started 2023 at $386K and are ending the year around $393K, a rise of 1.1%.

This is according to Zillow’s Home Value Index, which is a weighted average of the middle third of homes regardless of whether the home is for sale, and reflects the typical home value for the region.

Median Sale Price Reflects a Wealthier Buyer

The median sale price in Florida is markedly higher than Zillow’s home value index.

Florida started January 2023 with a median list price of $450K and is ending the year with home listings hovering around $468K, a 1.6% increase, according to Realtor.com.

This difference between home values and median list price is likely a reflection of the fact that more expensive homes are being sold. As cash buyers and a higher income tier move to Florida in search of a premium property, the homes listed and sold correspond to this homebuyer.

Homes Stay on the Market Longer

Homes in Florida are staying on the market for an average of 58 days. This is slightly higher than the national average of 52 days. And certainly more than the days of the Pandemic, where homes in Florida stayed on the market for approximately 34 days during the peak.

However, it’s notable that homes in Florida are still moving quicker than the historical days on market for Florida. In 2019, the average days on market in Florida was 74 days.

We’re unlikely to see a housing market like that of the past several years, where homes were flying off the market. In some ways, this gives both sellers and buyers a little breathing room and can be beneficial.

Increasing Mortgage Rates Cause Price Reductions

Relative to last year, at this time, 15% more homes have had a price reduction in Florida. This is the result of increasing mortgage rates, putting pressure on homeowners to reduce home prices.

As mortgage rates rise, homebuyers cannot afford a purchase price they previously could afford. The pool of available buyers also shrinks, forcing many homeowners to reconsider their listing price.

It is also possible that home sellers have a mindest reflective of the past couple of years and are pricing their homes like the Pandemic days when homes flew off the market at elevated prices. While the demand for homes in Florida remains strong, home sellers must look at the current housing market and price their homes accordingly.

Nevertheless, while the Nation has felt the impact of rising mortgage rates, inflation, and overall fear within the economy, Florida has remained strong. This points to the resilience of the Florida housing market and the ongoing attractiveness of Florida real estate.

The Florida Population: Massive Growth and a Younger Demographic

Florida cities comprise 4 of the top 10 areas people are moving to. Moreover, the population has grown by 3.1 million people over the past decade. That’s like most of Los Angeles moving to Florida; in fact, California is one of the top 3 places people are moving from to go to Florida.

In addition, the demographic of those moving to Florida has changed over the past several years. While Florida was known for it’s large retirement population, the majority of people moving to Florida in recent years is between the ages of 25-44.

Much of this migration was fueled by Covid. Both the option of remote work and the looser Covid policies of Florida drew people in droves to Florida.

As remote work went from a temporary option to permanent, many chose to leave colder, louder, or more expensive areas.

Furthermore, many people were attracted to the more relaxed Covid policies of Florida, including families who desired an in-person education for their children.

Still others moved to Florida to keep more money in their pocket. Florida has no income tax, lower property tax, and lower cost of living.

Florida Faces a Housing Shortage

While the population boom in Florida has been favorable to the economy, it has also put a strain on real estate. Coupled with the damage from Hurricane Ian, Florida has a severe shortage of homes.

Builders are working feverishly to build homes to keep up with Florida’s population growth, ranking Florida 3rd in the country for new home builds. Between the need for new homes and the repairs necessitated by Hurricane Ian, the construction business is booming.

Yet, Florida is also facing a shortage of workers due to a new immigration law that went into effect in July 2023, requiring all employers with 25 or more employees to use the E-verify system to confirm the legal status of their employees. Many construction companies have had workers leave due to fears of deportation, making it even more difficult to keep up with the demand for housing in Florida.

A Surprising Number of Homes for Sale in Florida

Shockingly, though, Florida’s real estate market has the most homes for sale in the Nation, with over 99K on the market. The next closest state is Texas, with almost 92K homes for sale. Followed by California with 46K homes for sale. These numbers are far above the national housing market median of 10,060.

Oftentimes, high home prices and a large number of homes for sale would spell disaster in the real estate market; however, not in Florida’s housing market. Fueled by real estate investors, high population migration, and strong buyer demand, the Florida market continues to be competitive and strongly sought after.

Homes in Florida’s Cities Drive Growth

Certainly, it is important to recognize that different areas within Florida command different results. Notably, the cities of Florida draw the most attention, while regions farther out have felt less of the impact of Florida’s growth.

Let’s take a closer look at three of the most popular locations in Florida’s housing market.

Miami

Miami has a median sale price of $556,750, up 1.2% year over year. While Miami is a popular destination, homes sell in approximately 59 days, and are often sold for slightly below the list price.

This makes Miami a viable location for those looking to move to a city in Florida. Miami is known for its vibrant nightlife, stunning beaches, and strong Cuban influence. Like many cities, condo living is more prevalent and affordable compared to single-family homes. While it might not be the ideal living location for everyone, it is an incredible city with a thriving Florida housing market.

Orlando

Orlando’s housing market has a median sale price of $385K, up 6.5% year over year. Homes sell in approximately 20 days, with some homes getting multiple offers.

Despite its popularity, the median sale price in Orlando is below the national average, making Orlando a very affordable place to live. Orlando is also home to the forever-popular Disney World. It also has a cost of living that’s 2% lower than the national average and 3% lower than Florida’s average.

Tampa

Tampa’s median sale price is down 2.5% since last year and sits at $400K. Homes sit on the market around 20 days and sell for approximately 2.3% below list price.

This somewhat competitive Florida real estate market provides homes close to the beach, incredible dining, and a vibrant cultural scene. Those ages 45-64 make up the largest percentage of the population at 27%. Those in their early 20’s (20-24) make up the smallest percentage (5.5%) of the Tampa population.

Home Insurance is a Rising Issue

Floridians face a significant rise in their home insurance premiums, which may pose a substantial threat to the housing market and current residents. Because of the increase in insurance claims, six property insurance companies have been deemed insolvent, and their expenses have fallen to the Florida Insurance Guaranty Association (FIGA). Subsequently, FIGA is imposing two 2% levies on all Florida homeowners’ policies to help pay for these rising costs. FIGA assessments and the overall increase in homeownership policy premiums mean that the average annual premium in the state spiked to $4,231. For comparison, California’s (the state with the highest cost of living) average homeowners insurance cost is only $1,380, according toInsurance.com.

The rising cost of homeowners insurance could threaten the Florida housing market, however, its overall impact is still yet to be determined.

Is it a Good Time to Buy or Sell in Florida?

The Florida real estate market continues to appreciate; therefore, even with higher mortgage rates, buying now could prove to be a worthwhile investment. The median sale price is predicted to continue rising between the strong demand and low inventory.

In addition, buyers are facing less competition in today’s Florida real estate market, making it an excellent time to buy a home.

This also makes for an excellent climate to sell in Florida. While your Florida home value will continue to rise, the low inventory makes your home more valuable. Should the inventory catch up in the future, your home may sit on the market longer, or the double-digit appreciation may slow.

Ultimately, the best time to buy a home in Florida or the best time to sell a home in Florida is when it’s right for you. While we all want to be real estate masters who buy low and sell high, that’s not a reality for most people.

A home is more than just the walls, and it’s important to recognize the memories you have or want to create. The inner joy that we have from where we live outweighs a few thousand dollars gained or lost.

Therefore, don’t let fear of the current economy or fear of the future paralyze your pursuit of a home. Work with an incredible realtor, do thorough research, tick all of the boxes (like a home inspection!), and feel confident with your choice.

Florida Housing Market Predictions 2024

As we look ahead to 2024, will the Florida housing market crash or continue to rise?

We don’t see a housing market crash in the Sunshine State in the foreseeable future.

Our Florida real estate forecast is that the Florida housing market will remain strong throughout 2024. Home values will rise, and as homebuyers become more comfortable with the state of the economy, they will reenter the market.

The Federal Reserve held interest rates steady at their November 1, 2023, meeting, and it is predicted that the Fed will cut interest rates by 1% in 2024.

Furthermore, inflation is predicted to ease from 3.2% (July 2023) to 2.2%. Prices will still rise, just not as rapidly.

The combination of lower mortgage rates, slower inflation, and more comfort with the housing market’s stability should give homebuyers the money and confidence they need to step into the real estate market.

Home sellers in Florida will benefit from buyer demand and rising home prices. It doesn’t look like home inventory will catch up anytime soon, which is an added benefit to any home seller.

While it’s essential for home sellers to evaluate comparable homes and create a reasonable listing price, Florida home sellers will be able to capitalize on home appreciation and strong buyer demand.

Florida’s real estate market will continue to shine and be strong throughout 2024.

Find a Trusted Florida Real Estate Agent

The best way to find the home of your dreams is to work with a top real estate agent who puts your ideals first. For a fast and easy way to find local Florida real estate agents, check out our FastExpert partners. We rank our agents based on sales and customer reviews and will match you with the perfect real estate agent. FastExpert makes real estate a little bit easier so that you can focus on what matters.